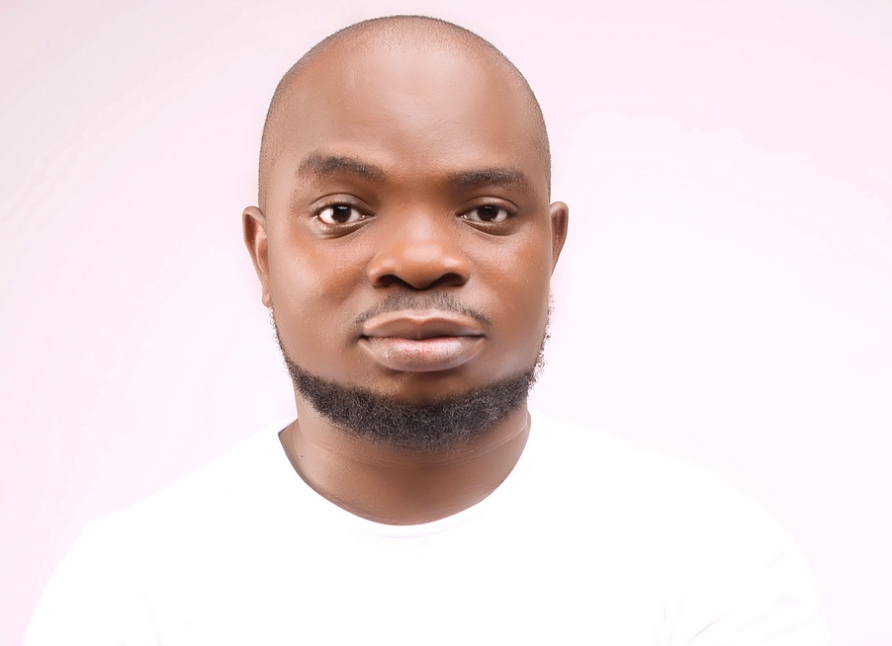

Nigeria is fast becoming world leaders the world with more cryptocurrency trading going on there than anywhere else with one of the more prominent investors being Lagos resident, Tola Fadugbagbe.

After undertaking a series of odd jobs earning the minimum wage to survive, in 2016 the 34-year-old saw a Bitcoin advert after which his cryptocurrency journey began.

"I was spending hours every day watching videos on YouTube and reading articles about Bitcoin,” he recalled, “and I didn't have much money so I started with $100 to $200." It was a decision that transformed his life forever.

Now Mr Fadugbagbe is trading full time and teaches budding investors. He since said, at an early stage, that he had cryptocurrency worth more than $200,000 (£140,000) in his possession. And, furthermore, he has not looked back since.

"I'll soon be moving into my own house, which I'm building,” he said. “Now I have a very big farm - courtesy of cryptocurrency," he said. "No Nigerian comes to cryptocurrency and wants to look back. It's a big opportunity."

Tola’s story is just one of millions of Nigerians who have been attracted to digital currencies such as Bitcoin, with 2020 survey by data platform Statista revealing that 32% of the country is using cryptocurrencies - the highest proportion of any country in the world as it makes alternative sources of income and alternative currencies attractive.

Estimates show that of the top 10 countries for trading volumes, Nigeria ranked third place after the US and Russia in 2020, generating more than $400m worth of transactions. The Central Bank of Nigeria devalued the currency, the naira, by 24% last year, with fears of a further fall in value by as much as 10% this year.

Many Nigerians, however, have been reporting that their bank accounts have been frozen due to cryptocurrency-related activity, but Mr Fadugbagbe's bank manager managed to call him and advise him that his account would be closed, giving him a day to transfer his funds – which he managed to do, leaving him ,and many other investors, say that they will continue to trade using their overseas bank accounts.

At the heart of the rise of Bitcoin in Nigeria is a distrust of centralised financial systems and top-down economic control, investors say. Many express their frustrations with government policy and the decline of the Nigerian economy.

None more so than Mr Fadugbagbe, who spent years struggling to scrape by as what he describes as a "minimum-wage slave".

"I don't do shares and government bonds", he says. "Those are scams. I trust cryptocurrency more."