New research from online investment service Wealthify reveals a fifth (20%) of UK parents try to save for their children because they fear life will be harder for them. This follows the news that the cost of living has soared to its highest rate in 10 years.

Almost a quarter (22.8%) of UK parents feel like they don’t have enough income to save for their children - despite 45% earning more than the average UK salary (£31,000). Nearly one quarter (22.8%) of parents in the UK haven’t set up any savings for their children while over three quarters (76.4%) plan to:

- Out of those who plan to or already save for their children, Junior Cash ISAs were the most popular (50%).

- 40% of parents plan to save between £5,000 and £15,000 by the time their children reach 21.

- 35% of parents plan to save more than £15,000 by the time their children turn 21.

Below, Wealthify uncovers how parents plan to save to support their children when they reach key milestones.

1. First home

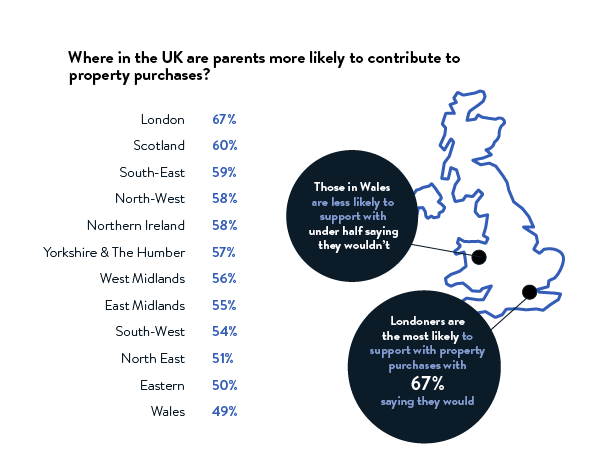

43.9% of parents said they plan to contribute to their child’s first property:

- Over half (54%) of those contributing said they plan to give between £10,000 to £30,000.

- 18.3% of parents contributing to a new home plan to give between £30,000 - £50,000

- 1 in 17 (5.8%) parents would contribute £50,000 - £70,000.

- Parents living in London are more likely than any other region to contribute to their child’s first home, with 67% saying they would help.

- Welsh parents are the least likely to support with home purchases, yet over half (51%) will still contribute.

- Only 30% of parents surveyed had financial support from their families to buy their first home.

2. Higher Education

With more young people attending university in the UK than ever before and tuition fees increasing, it seems parents’ finances are taking a hit too:

- One third (30%) of parents say they would not contribute to the cost of their children’s higher education.

- 43% of parents who said they will contribute expect to fork out between £1,000 to £3,000 per year towards higher education.

- Almost a fifth (18.1%) of Londoners anticipate spending more than £5,000 per year to support their child, the highest percentage of parents to say this compared to the rest of the UK.

3. Weddings

35% of parents surveyed are committed to contributing to their children’s weddings:

- Most parents (42.8%) plan to spend between £1,000 to £5,000 on their children’s weddings.

- Over a quarter of parents (27%) plan on spending in the realm of £5,000 to £15,000.

- Parents in Northern Ireland were the most likely to say they would not contribute to their children’s ‘big day’ (47.5%) compared to Londoners, who were least likely to say they wouldn’t help fund a wedding (30.2%).

- 35% of UK parents plan to contribute to their children’s future weddings but 42% of parents received financial support from their own parents. This suggests that covering the cost of weddings may be less of a priority for Brits as time progresses.

4. First car

Nearly half (46.9%) of all UK parents plan to contribute to their children’s first car purchases – rising to 50.3% in Scotland and 50% in Northern Ireland, the highest rates compared to the rest of the UK. Further stats:

- UK parents will fork out an average of £1,912 on a car for their child.

- Parents in the East Midlands were the least likely to say they will contribute (42.8%).

- Londoners will spend out the most, with the average London parent spending almost £500 more than the national average, at £2,455.

- Parents in Wales plan to spend the second most at £2,282 per child, closely followed by parents in Northern Ireland who will spend £2,013.

- Parents in the East Midlands were found to be most frugal on the cost of motors, spending almost £1,000 less than those in London.

Simon Holland, Chief Product Officer, Wealthify comments: “As the cost of living rises across the country, it’s no surprise that parents are finding it difficult to save for their children. However, as time goes on, big purchases like a car or home will become much less attainable for our kids – so, it’s important we help to give them a financial head start if we are able to.

“You can open up a Wealthify Junior Stocks and Shares ISA (JISA) to start investing towards your child’s future from as little as £1. What’s more, you can spread the cost by inviting family and friends to contribute. If you don’t think you can afford payments every month, no pressure – Wealthify JISAs are flexible, so you can pay in as much as you like, as often as you like, ready for your child to access when they turn 18.”